My economics professor used to say “There’s no such thing as a free lunch”. Incentives and rebates for energy upgrades may not eliminate all costs for kicking gas and energy wasting appliances, but they sure can help take a bite out of the total project cost.

1) Find out how Makello can help you. 2) Discuss your energy needs. 3) FREE Energy Savings Estimate.

Finding and navigating programs can be confusing and frustrating so we have developed a brief summary of programs and categorized tables of incentives as a handy reference guide.

SUMMARY OF INCENTIVE PROGRAMS

Inflation Reduction Act (IRA)

A very popular provision of the Inflation Reduction Act is the increase of solar/ battery tax credit from 26% to 30% for 2022-2032. This tax credit had previously been scheduled to drop to 22% in 2023, and sunset in 2025.

Commercial properties aren’t excluded from the savings. Commercial properties are eligible for a Federal Solar Tax Credit of 30% or for accelerated depreciation or Section 179 tax credits, up to 100% Write-Off; a total of up to 50% subsidies on solar-battery.

HomeOwner Energy Savings (HOMES)

Rebates are subject to State implementation but the Federal Inflation Reduction Act of 2022 Legislation sets the maximum values. States may increase the maximum value of the rebates for low and moderate income households. It is important to note that the HOMES Program rebates cannot be combined with the High-Efficiency Electric Home Rebate Act (HEEHRA) Program.

High-Efficiency Electric Home Rebate Act (HEEHRA)

The Inflation Reduction Act of 2022 provided $4.275 billion for grants to State Energy Offices and $224 million to Indian Tribes for the purpose of establishing home electrification rebate programs. A key element of this program is the program explicitly includes rebates for main panel upgrades and electric wiring.

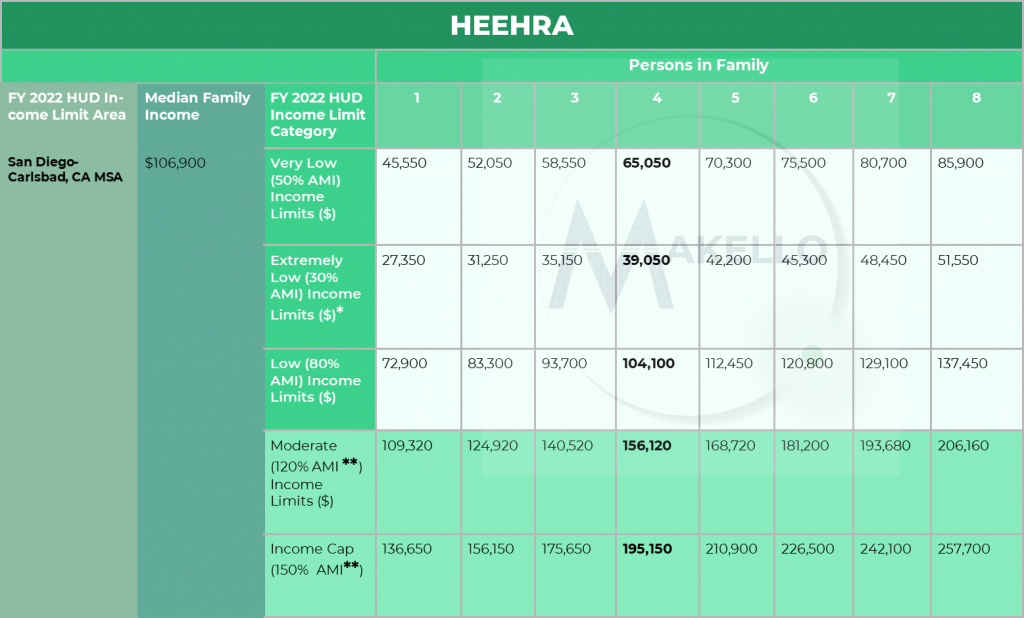

The rebate caps are income based. Single family households earning less than 80% of the Area Median Income may be eligible to receive 100% of project cost or the maximum rebate amount, whichever is less. Single family households earning between 80% and 150% of area median income have rebate amounts capped at 50% of project cost or maximum rebate amount, whichever is less. Households earning more than 150% of area median income do not appear to be eligible for these rebates. The maximum dollar amount of rebates offered under the HEEHRA program is $14,00 to any single household. The rebates are slated to be distributed up front at the point of sale.

TECH Clean California

The initial budget for the program was $120 million. The program was wildly popular and the budget was exhausted unexpectedly quickly and is currently suspended in most areas including SDGE territory. The State Legislature recently funded an additional $145 million to the budget to expand the program. Currently, budgeting efforts are underway to assign each territory in California its allotment of the funds.

California Energy Smart Homes

Both pathways have a number of requirements in order to receive the incentives. Obtaining the handbook from California Energy Smart Homes https://www.caenergysmarthomes.com/ is recommended for detailed information and help you to find the pathway that is right for your project.

Comfortably California

Incentives are offered to the distributors for pass-through to the contractor. The programs allow contractors to develop marketing programs that offer customers a competitive price. Visit https://www.comfortablyca.com/ for more information.

Homeowners wishing to test induction cooking can borrow a portable induction cooktop for three (3) weeks through the San Diego Green Building Council Electric Home Cooktop Program. The program is free and to sign up to check out a cook top visit https://www.sd-gbc.org/electric_home_cooktop_program_launch

Makello’s Ethical Energy Savings Report is the result of a detailed trade-off study of discount utility rates, Community Choice Aggregation options, grants, rebates, tax credits, and equipment options, to determine the fastest payback and highest return on investment, to meet your home, business and vehicle energy needs.

TABLES OF INCENTIVES

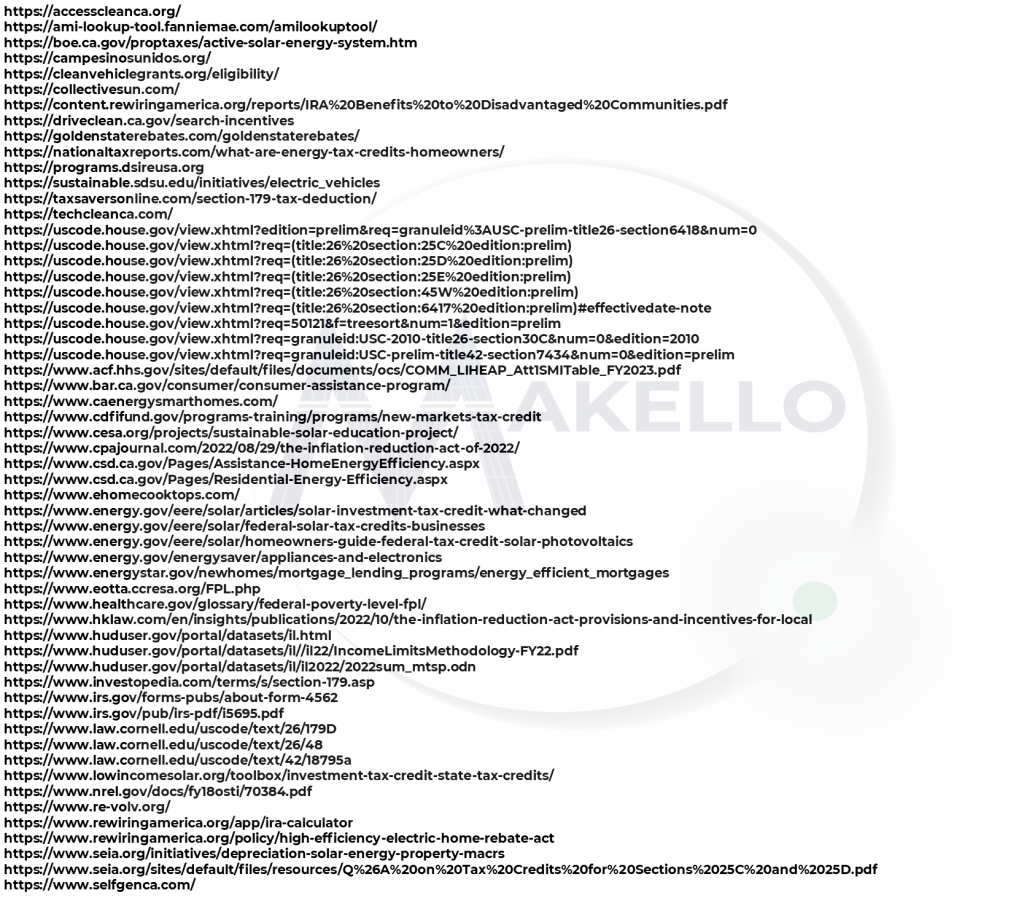

Whole Home Energy Reduction

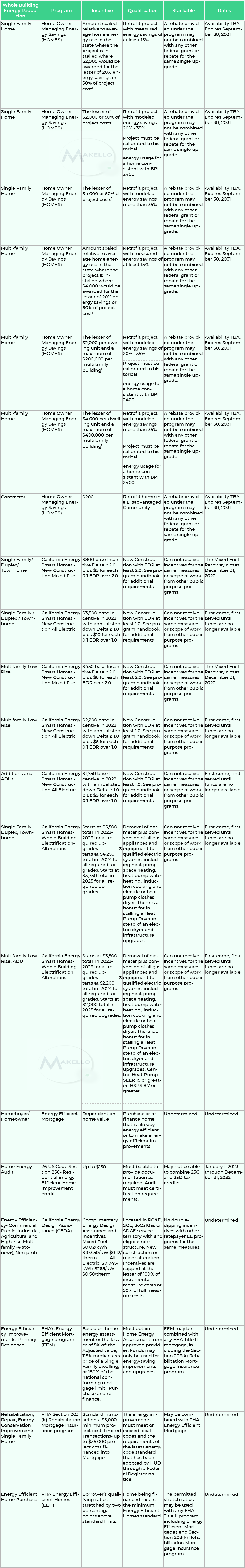

BASIC WEATHERIZATION

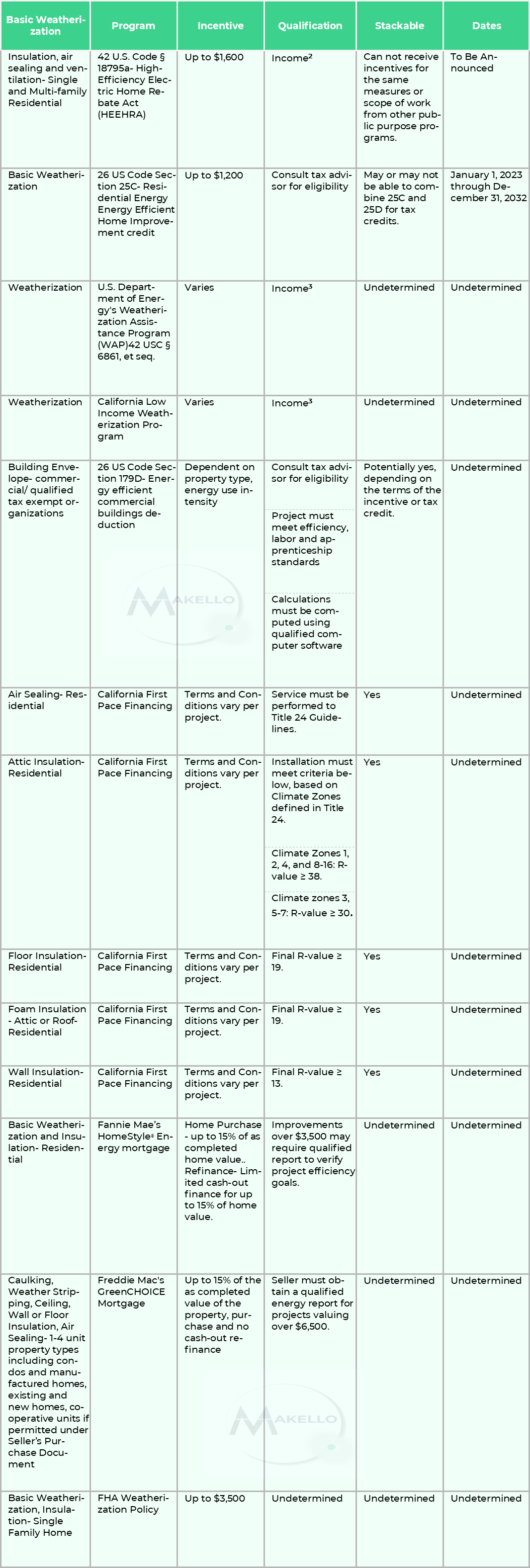

ELECTRICAL UPGRADES

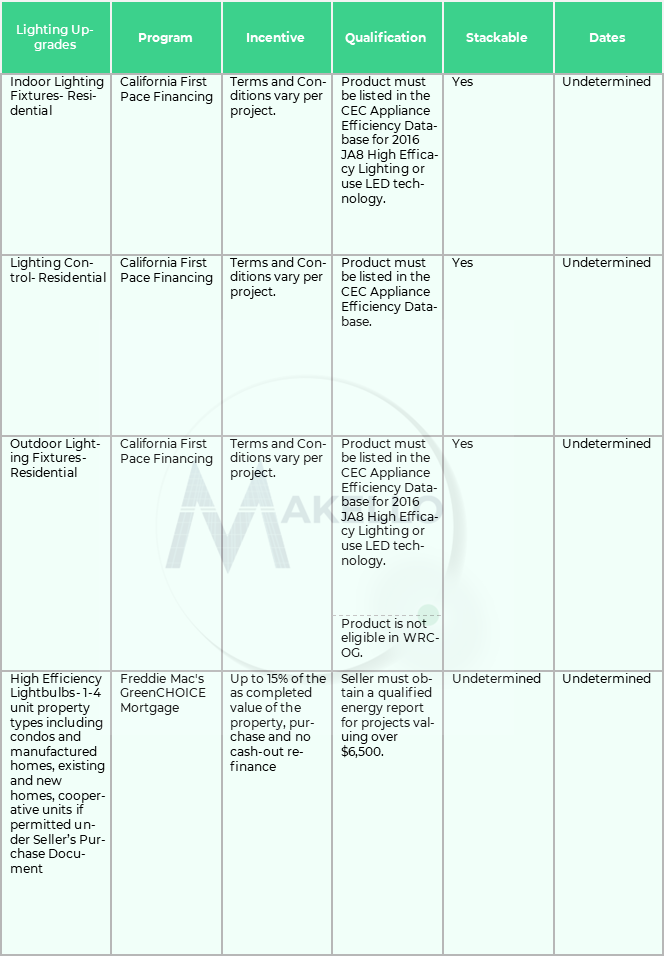

LIGHTING UPGRADES

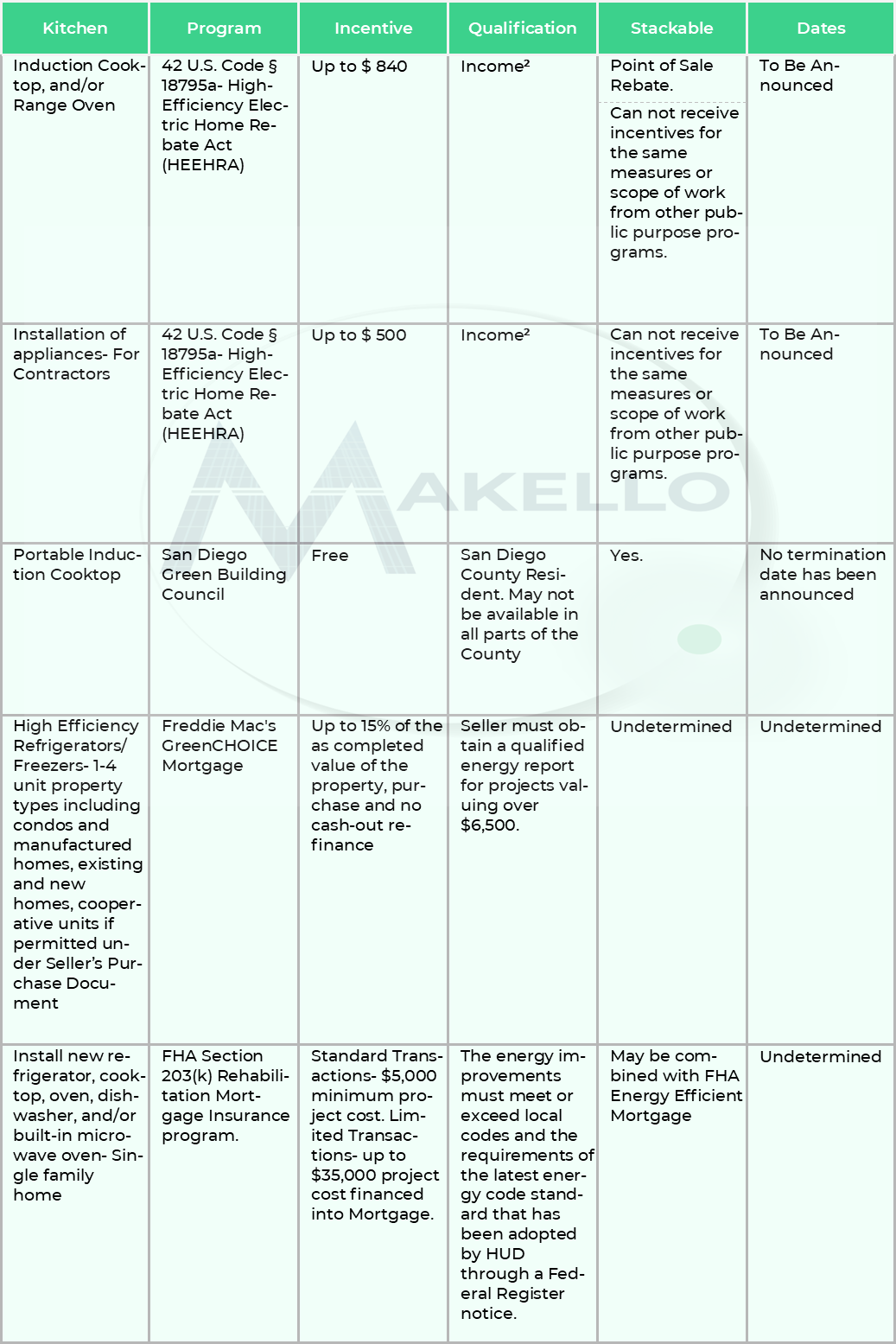

COOKING

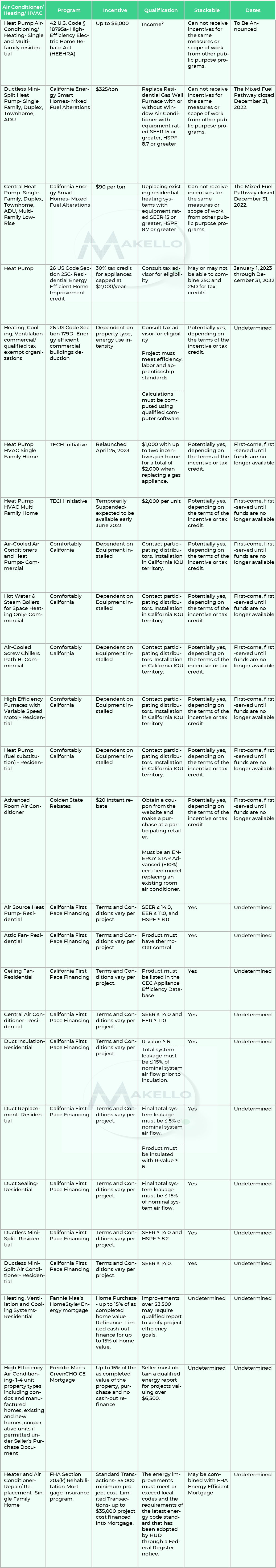

AIR CONDITIONING (Heating & Cooling)

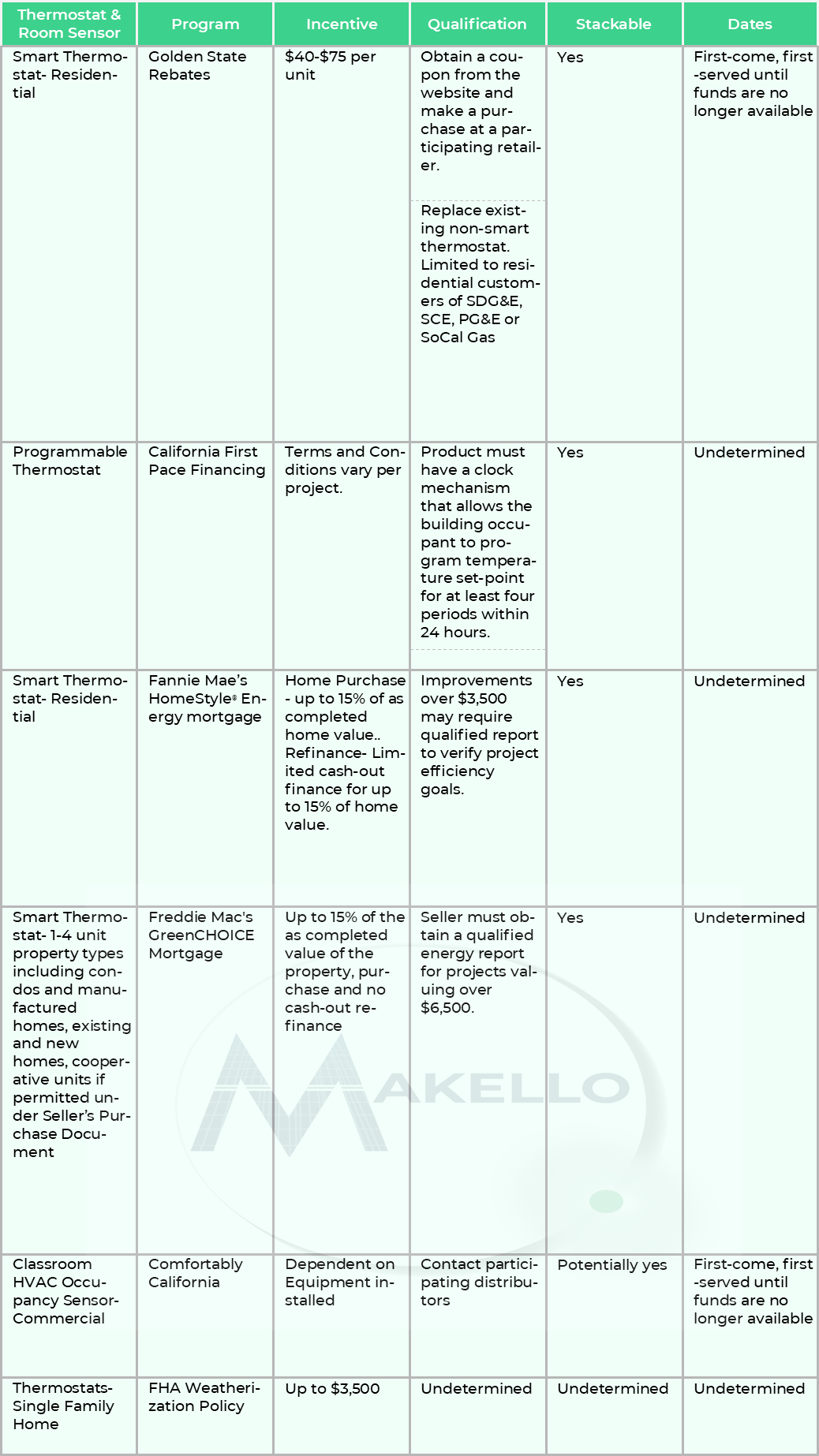

THERMOSTATS & OCCUPANCY SENSOR

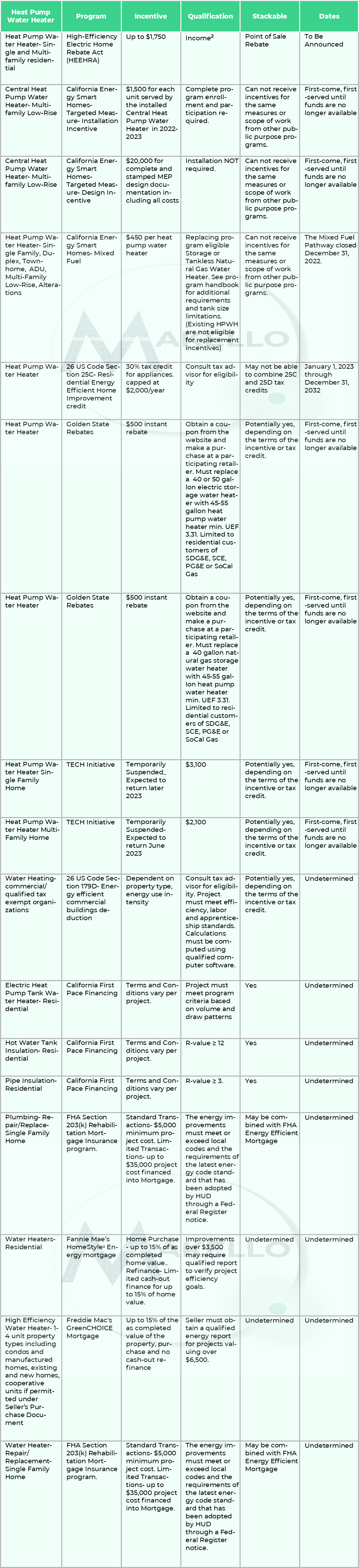

HEAT PUMP WATER HEATING

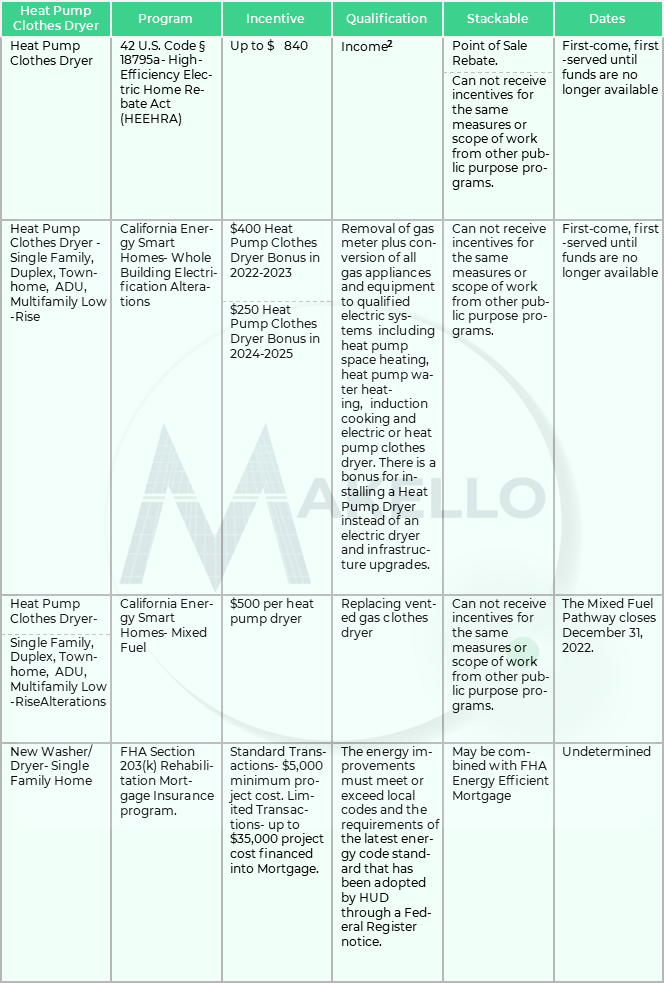

HEAT PUMP DRYER (Clothes)

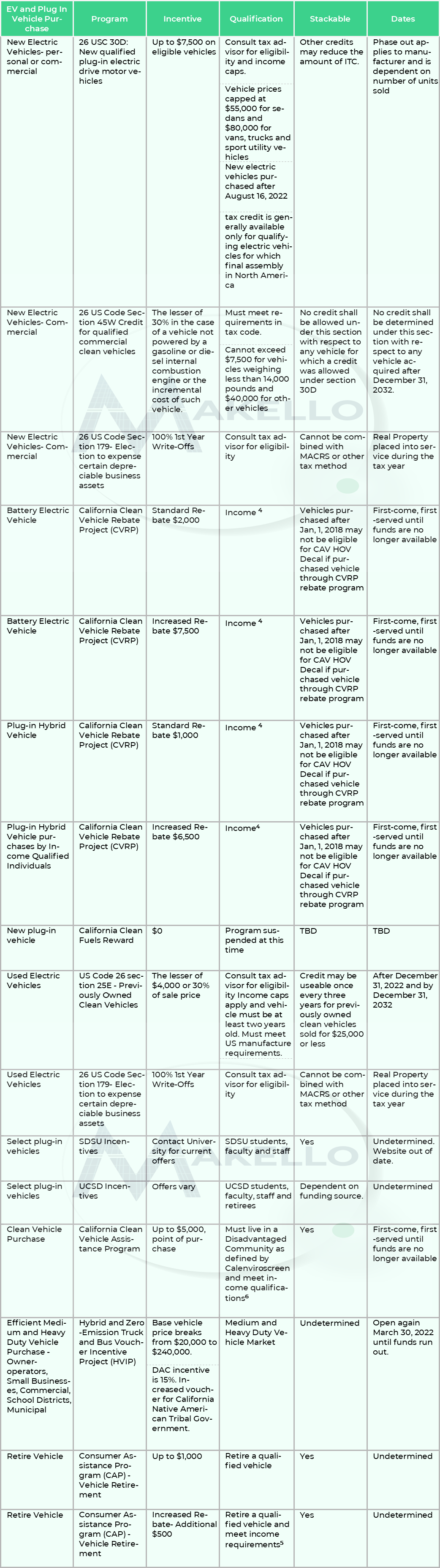

PLUG-IN VEHICLES

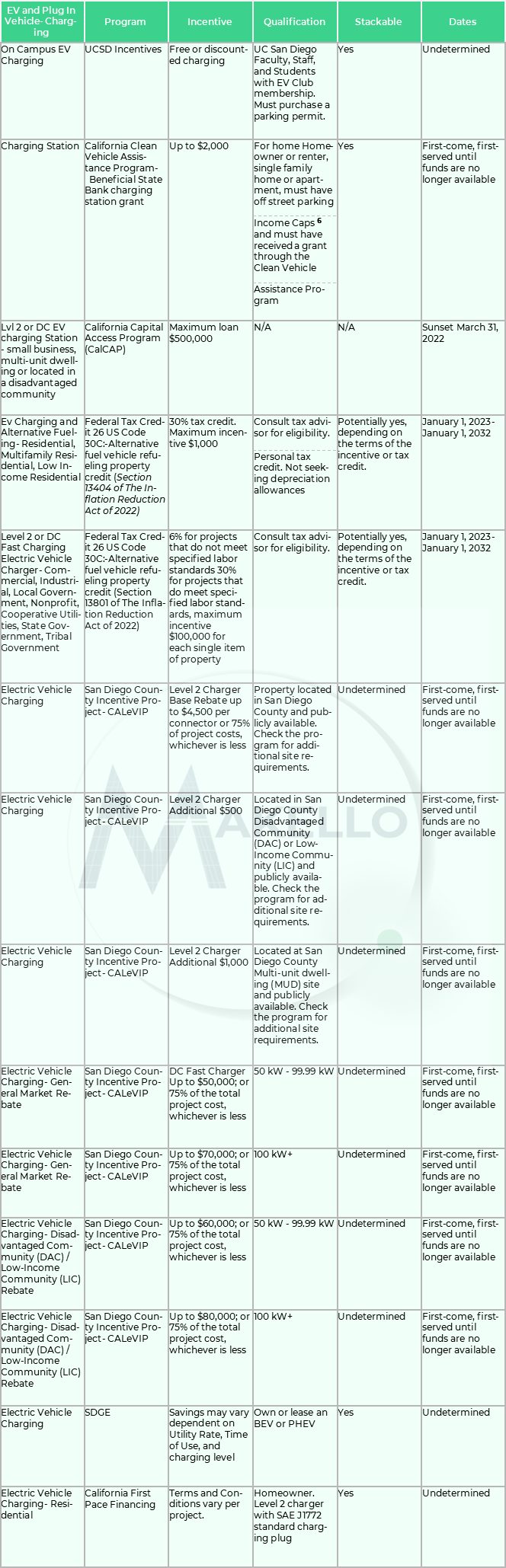

PLUG-IN VEHICLE CHARGING

PLUG-IN VEHICLE MISCELLANEOUS

SOLAR PV

ADVANCED ENERGY STORAGE

POOL HEATING, CHILLING AND PUMPING

Makello can help you prepare to take advantage of upcoming savings through our detailed Ethical Energy Savings Report. The Ethical Energy Savings Report is the result of a detailed trade-off study of discount utility rates, grants, rebates, tax credits, and equipment options, to determine the fastest payback and highest return on investment to meet your home, business and vehicle energy needs.

The fee for the Ethical Energy Savings Report is refundable (less the 3rd-Party $15 utility data access charge) or credited towards our installation services, after you attend the presentation meeting and complete a 5 minute survey after permission to operate. Service includes up to 7.5 hours research, and 1 hour Q&A, by an Ethical Energy Efficiency Expert and Research Assistants. Visit Makello.com today to book your appointment.

Disclaimer: We are not tax professionals. This guide is not intended to be Tax or Legal Advice, does not guarantee eligibility for credits, rebates or refunds and is not meant to be relied upon for eligibility for any program, rebate, refund or tax credit. Please seek advice from a qualified tax professional to determine eligibility for any particular program or tax credit, refund or rebate.

We make every effort to verify program information however, program metrics can change. Please contact program administrators with questions regarding their program.

Disclaimer:

We have done our best to verify all the information in the tables. Please contact info@makello.com to report errors within the tables.

Notes:

1 Rebate amounts for income qualifying households may be higher than stated amounts.

2 ETA: mid-to late 2023. Low-income households (those making below 80% of their area median income) are potentially eligible to have 100% of their costs covered. Moderate-income households are potentially eligible to get up to 50% of their costs covered. Eligibility requirement for rebate, up to 150% Area Median Income.

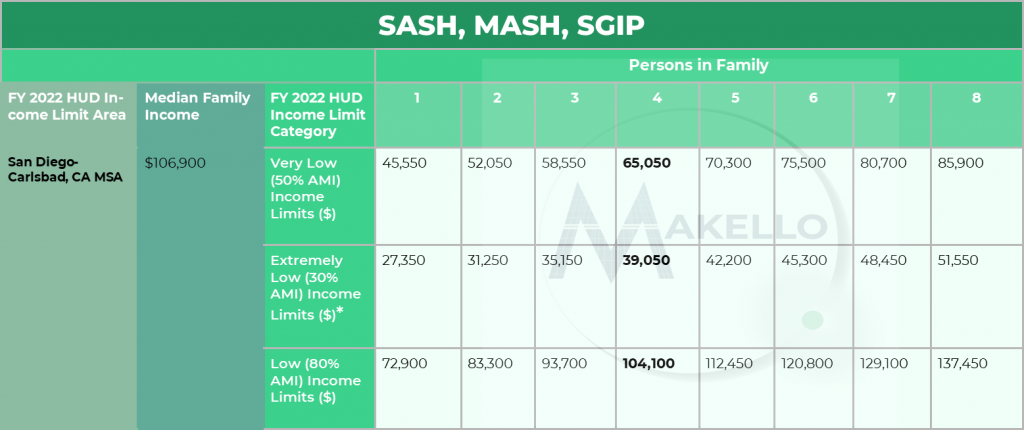

* The FY 2014 Consolidated Appropriations Act changed the definition of extremely low-income to be the greater of 30/50ths (60 percent) of the Section 8 very low-income limit or the poverty guideline as established by the Department of Health and Human Services (HHS), provided that this amount is not greater than the Section 8 50% very low-income limit. Consequently, the extremely low income limits may equal the very low (50%) income limits.

**Income estimates calculated by Makello are not official calculations and may not be the correct income level as determined by program administrators. We have made our best faith attempt to estimate the correct value based on information provided by HUD noted below.

Y 2022 Multifamily Tax Subsidy Projects Documentation System

NOTE: Very low-income (50% Income Limits) calculations published by HUD are used as the basis for determining the full range of income limits for minimum set-aside tests. The following illustrates the calculation of additional limits:

80% limit: 160 percent or (80/50) of the income limit for a very low-income family of the same size.

70% limit: 140 percent or (70/50) of the income limit for a very low-income family of the same size.

60% limit: 120 percent or (60/50) of the income limit for a very low-income family of the same size.

50% limit: Equals the income limit for a very low-income family of the same size.

40% limit: 80 percent or (40/50) of the income limit for a very low-income family of the same size.

30% limit: 60 percent or (30/50) of the income limit for a very low-income family of the same size.

20% limit: 40 percent or (20/50) of the income limit for a very low-income family of the same size.

For each person over eight-persons, the four-person income limit should be multiplied by an additional 8 percent. (For example, the nine-person limit equals 140 percent [132 + 8] of the relevant four-person income limit.) HUD rounds income limits up to the nearest $50. Local agencies may round income limits for nine or more persons to the nearest $50, or they may use the un-rounded numbers.

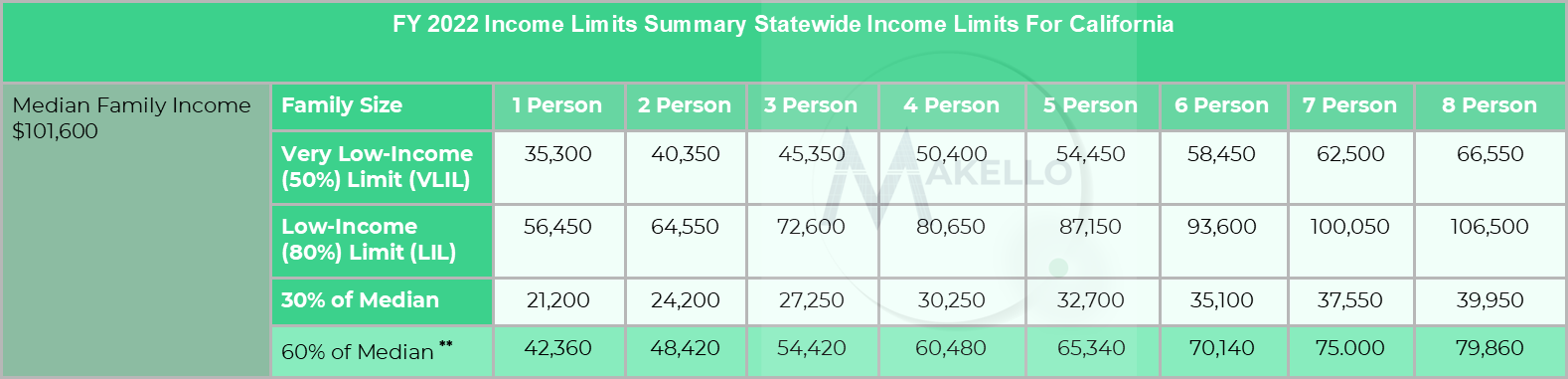

3 Eligibility is based on the household’s gross income over the past 12 months. Household income cannot exceed 60% of the State Median Income Level

**Income estimates calculated by Makello are not official calculations and may not be the correct income level as determined by program administrators. We have made our best faith attempt to estimate the correct value based on information provided by HUD previously noted.

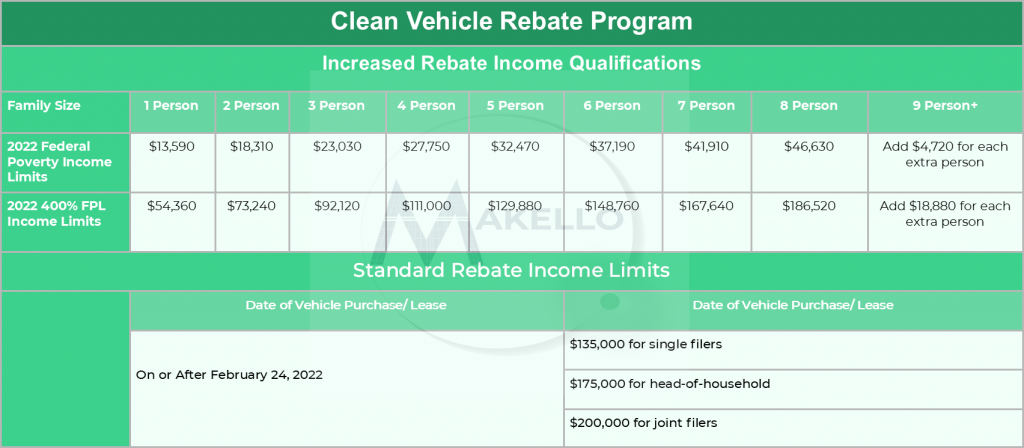

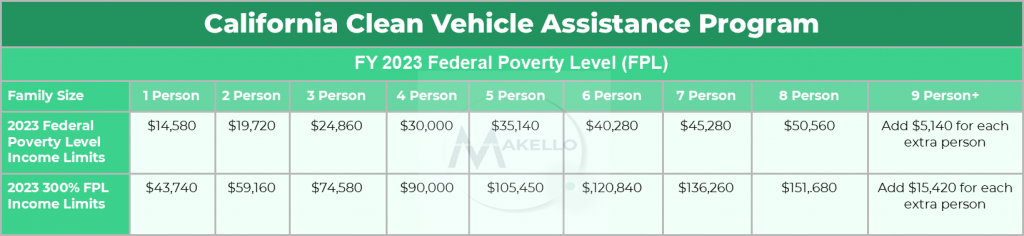

4 income less than or equal to 400% of the Federal Poverty Level

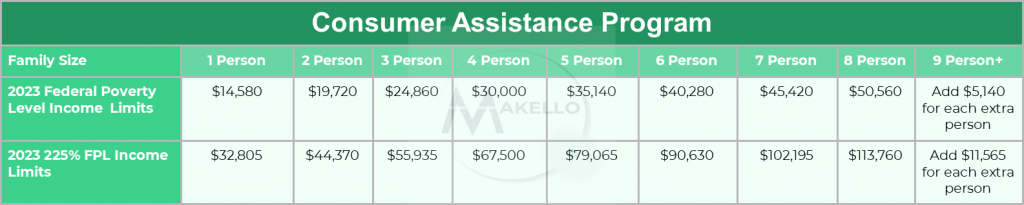

5 Income less than or equal to 225% of the Federal Poverty Level

6 **Income calculation based on 400% of the Federal Poverty Level (FPL) (2021). Income criteria is updated to the next calendar year FPL on April 15th annually.

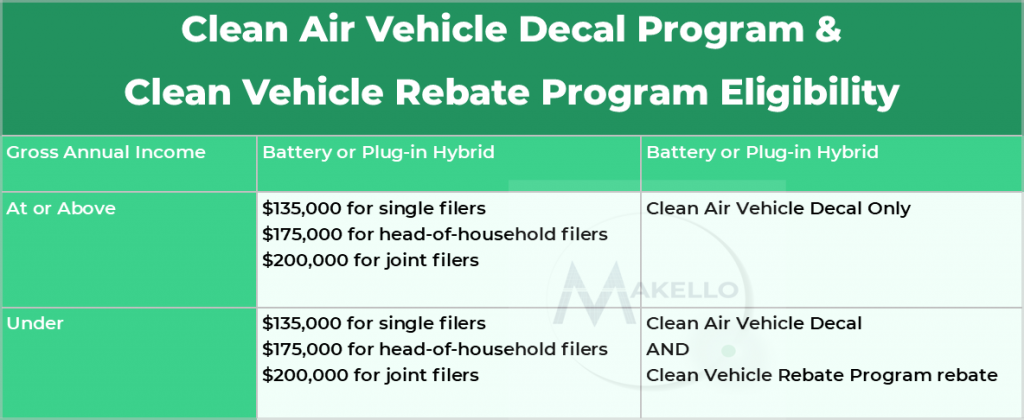

7 Clean Air Vehicle Vehicle Decal Program

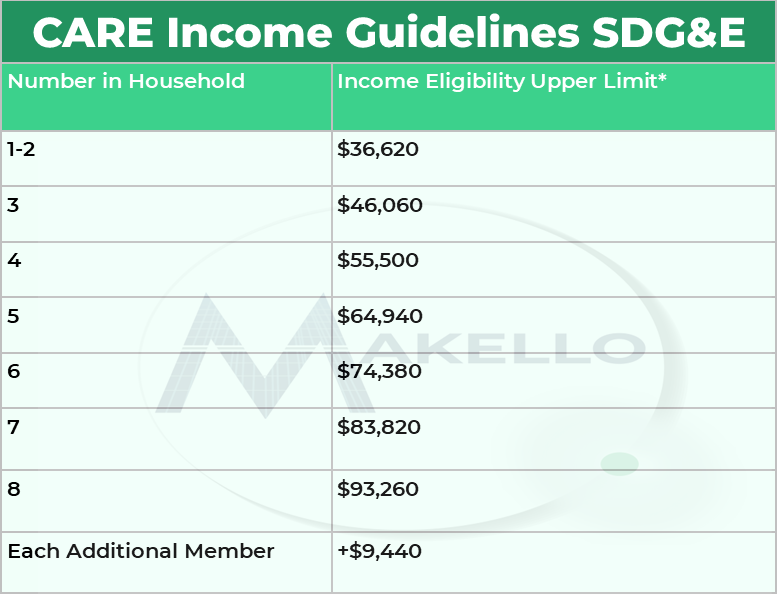

8 CARE updates after May 31, 2023. Upper limit calculation = 200% of Federal Poverty Level (FPL)

DAC SASH Homeowners must also meet income qualifications as denoted by annual CARE and FERA guidelines.

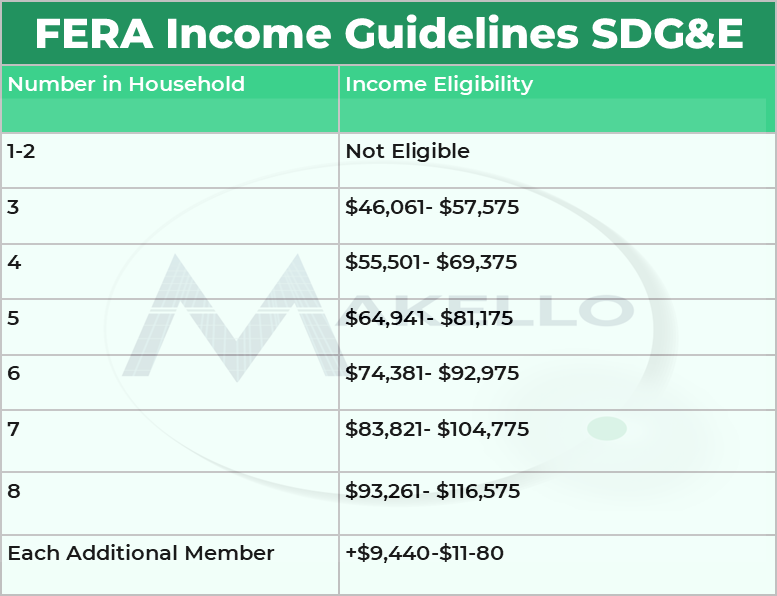

9 FERA updates after May 31, 2023

*Lower limit calculation = 200% of Federal Poverty Level (FPL) (CARE/ESA) +$1

**Upper limit calculation = 250% of Federal Poverty Guidelines

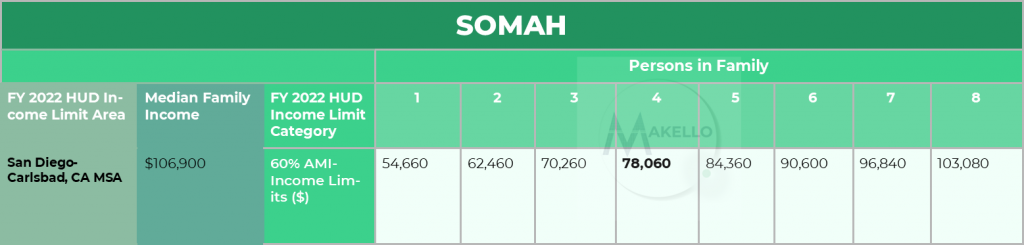

10 SOMAH Income Limits = 60% Area Median Income (AMI)

11 SASH, MASH and SGIP Income Limits

As of June 2020, the SASH program in SDG&E utility territory is fully reserved (based on incentive dollars) and closed to any new applications.

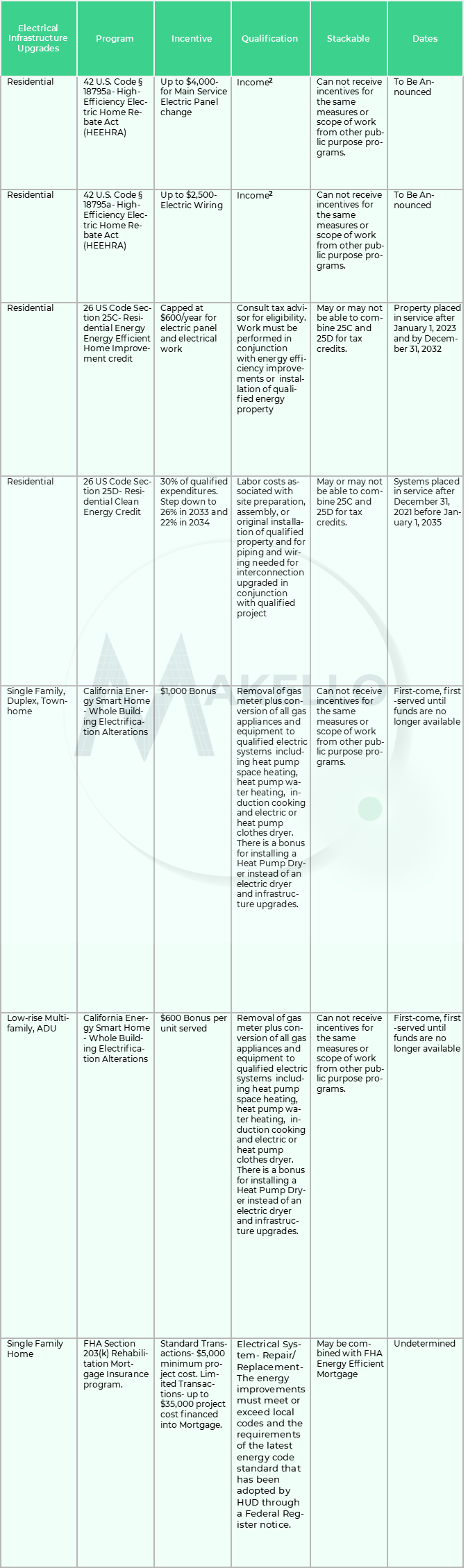

Sources: